How to Estimate Potential Rental Income for a Specific Area

Estimating the potential rent of your investment property is essential

In the high-stakes world of commercial real estate, "location, location, location" is only half the story. The other half is income potential. Whether you are looking to acquire a retail strip, a warehouse, or a Class A office space, your success hinges on one question: How much rent can I realistically collect?

Pricing too high leads to the "death by vacancy" cycle, while pricing too low leaves significant money on the table. Here is the professional framework our brokerage uses to estimate potential rental income for any specific area.

The Foundation: Hyper-Local Comparable Analysis

The most reliable data point for future rent is current rent at similar properties. However, in commercial real estate, "similar" goes beyond square footage. You must ensure you are comparing apples to apples regarding asset class and grade. A newly renovated Class A office space cannot be compared to a Class B building down the street, even if they share a zip code.

Beyond the physical building, look at the lease structures. An area might show high rent numbers, but if those are Gross Leases where the landlord pays all expenses, the net income might be lower than a NNN (Triple Net) lease with a lower sticker price. Always ask about "hidden" terms like concessions; a high headline rent is often offset by several months of free rent or a massive tenant improvement (TI) allowance.

Evaluating the Pillars of Desirability

Once you have a baseline from the comps, you must adjust your estimates based on micro-factors. For industrial assets, proximity to highway interchanges or rail is the primary driver of value. For retail, it is about daily car counts and being on the "going-home" side of the road traffic.Furthermore, you must look at the future of the area. Checking with the local planning commission is vital—is a major employer moving in nearby, or is a competing development about to flood the market with 50,000 square feet of new space? In 2026, power infrastructure has also become a critical factor. Buildings with high-amperage power service now command a premium as AI data centers and advanced manufacturing facilities seek out ready-to-use sites.

Working the Financial Formulas

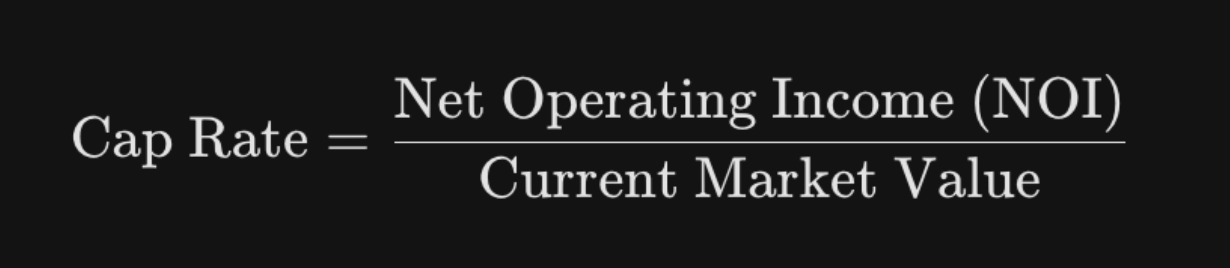

Professional investors often use the Cap Rate back-calculation to see if a specific area’s rent justifies the acquisition cost. If you know the prevailing Cap Rate for a neighborhood (e.g., 6.5%), you can work backward from the property value to see what Net Operating Income (NOI) you need to hit to make the investment viable.

Leveraging Professional Data

Manual research only goes so far. To get a truly accurate estimate, we utilize industry-leading platforms like CoStar and CompStak to access "behind the curtain" data. These tools allow us to see verified lease data that isn't always public, including the exact concessions and effective rent rates that define the current market.

Estimating rental income isn't just about looking at what the building next door is doing today—it’s about predicting what the market will demand tomorrow. Factors like rising insurance premiums and shifting work patterns mean your analysis must be as current as possible.

Nonetheless, the easiest and best way to really identify what a market rental rate should be would be to contact a commercial real estate agent that specializes in both the market and asset class.Ready to find the true value of your next investment? Our team at Commercial Brokers International specializes in deep-dive market surveys that go beyond the surface. Contact us today for a complimentary Rental Income Assessment of your target area.

Tel: (310)943-8530

Email: info@cbicommercial.com